Medium-Term Business Plan

Overview of the Medium-Term Business Plan

“Contributing to the preservation of the Earth and the prosperity of the human race,” as stated in our Corporate Philosophy, is tantamount to contributing to a “Sustainable Earth” and a “Safe and Comfortable Life for People,” as expressed through our social mission. We have therefore included in our 2030 Vision our goal of becoming: “a company that lives up to societal expectations and the aspirations of employees.” We will seek to achieve the 2030 Vision through our SDG-related initiatives. Also, we have defined “Let’s try first,” “Let’s connect,” and “Let’s polish up” as core values that will guide us in our actions as we endeavor to become the company we envision.

Phase 3 Overview

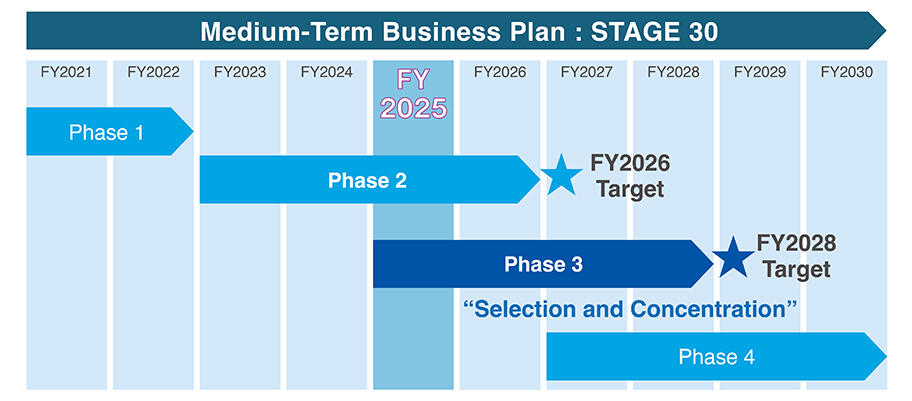

We have adopted a rolling approach for our medium-term business plan, under which four-year plans are reviewed every two years, so that we can flexibly revise strategies in response to ongoing geopolitical and economic uncertainties.

Phase 3, which begins in fiscal 2025, will promote portfolio restructuring through “Selection and Concentration” with the aim of improving capital efficiency. Specifically, we will define our current and next-phase growth drivers and work to significantly expand their sales. At the same time, we will pursue downsizing, withdrawal, or capital alliances for non-core businesses and low-profit businesses.

Materiality and Phase 3 Targets

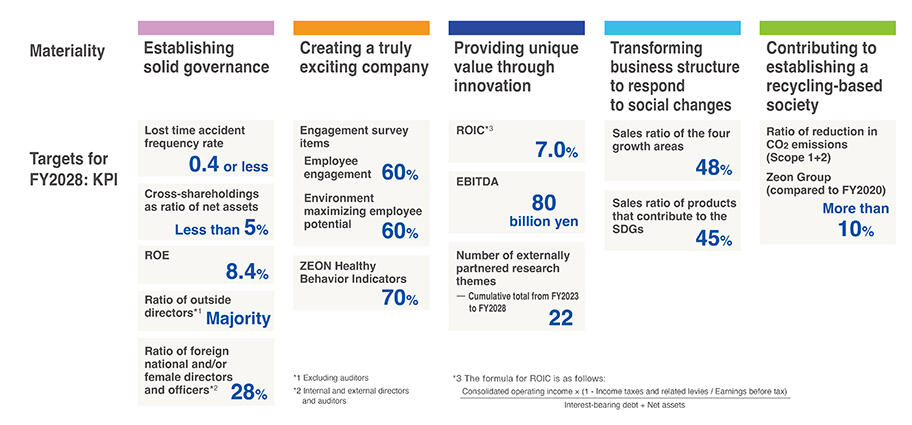

To ensure continued sustainable growth together with society, we have identified material issues that each require focused efforts. In Phase 3, we have set specific targets (KPI for fiscal 2028) framed around these material issues to meet stakeholder expectations.

Phase 3 Financial Targets

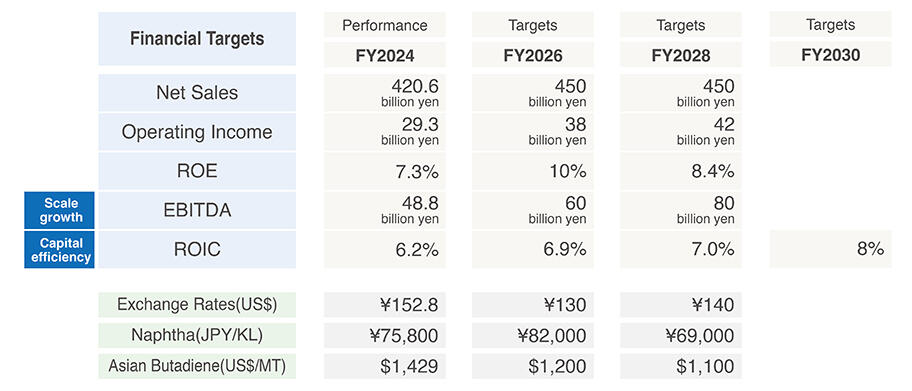

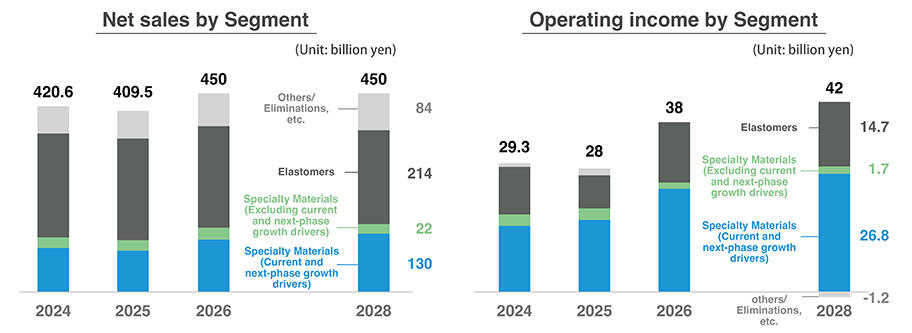

We have established these financial indicators as our targets for Phase 3: net sales, operating income, ROE, EBITDA as an indicator of growth scale, and ROIC to evaluate capital efficiency.

Setting net sales targets for fiscal 2026 and fiscal 2028 at the same level reflects our intention to improve operating income while maintaining topline performance through portfolio restructuring. We also plan to increase EBITDA in line with our growth investments.

Products and Markets in Phase 3

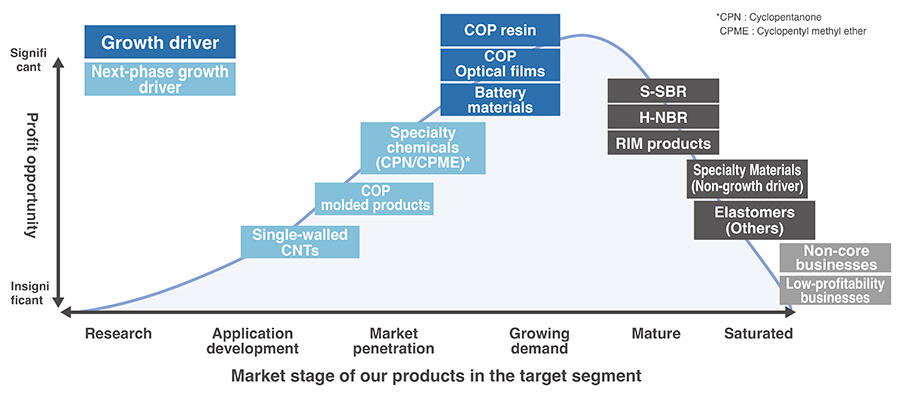

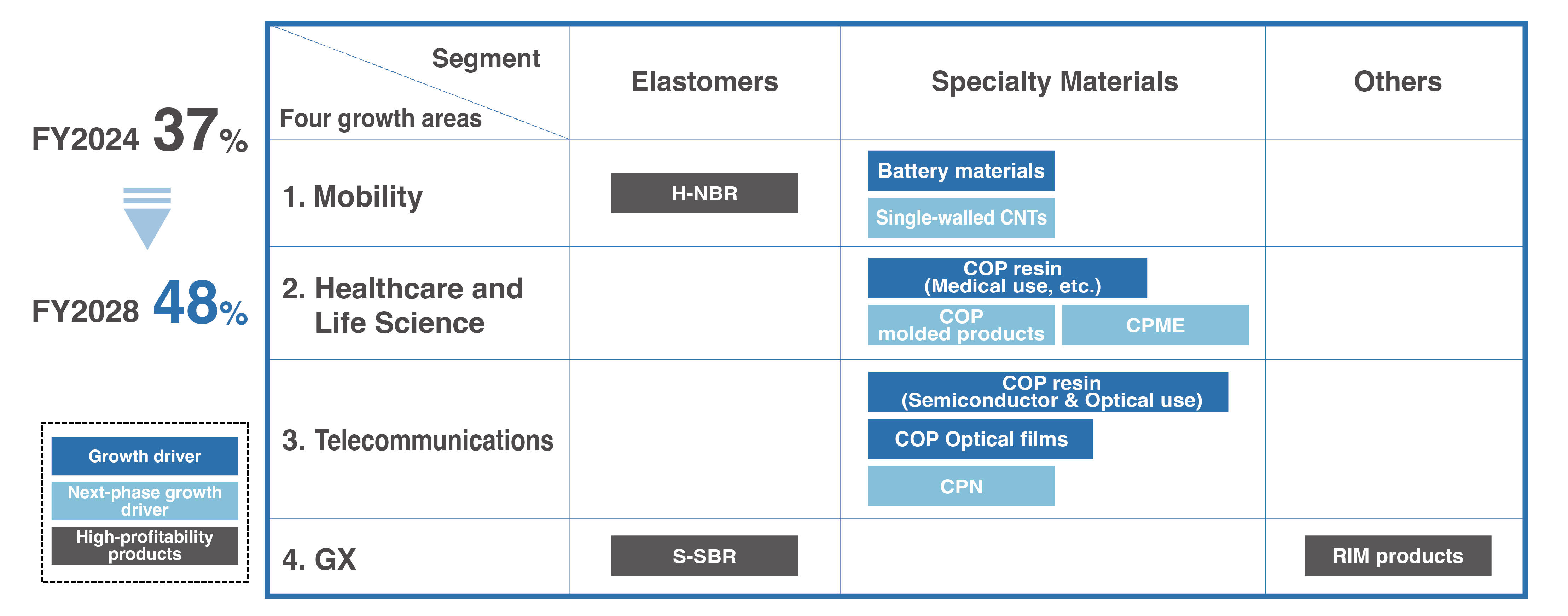

The chart below illustrates our approach to “Selection and Concentration” in Phase 3. Growth drivers are the businesses we have positioned to lead growth during Phase 3, while next-phase growth drivers are those we aim to expand further in Phase 4 and beyond, and we will allocate resources strategically to these businesses.

While high-profit products and core products in the maturity stage will continue to form the foundation of our business, we will promote downsizing, withdrawal, or capital alliances for non-core businesses and low-profit businesses as part of our active portfolio restructuring efforts.

Four Growth Areas in Phase 3 and Their Sales Ratio

In Phase 3, we have set the sales ratio of our four designated growth areas—mobility, healthcare and life sciences, telecommunications, and GX—as a KPI.

The table below shows how our growth drivers, next-phase growth drivers, and high-profit products are positioned within each growth area. By focusing resources on these businesses, we aim to raise the sales ratio of the four growth areas from 37% in fiscal 2024 to 48% in fiscal 2028.

The graphs below show the percentage of total sales and operating income represented by current and next-phase growth drivers in both actual results and targets.

The elastomer business is positioned as a key segment supporting the foundation of our operations, with plans to maintain stable sales while improving operating income. With that foundation in place, we aim to generate additional profit through our current and next-phase growth drivers.

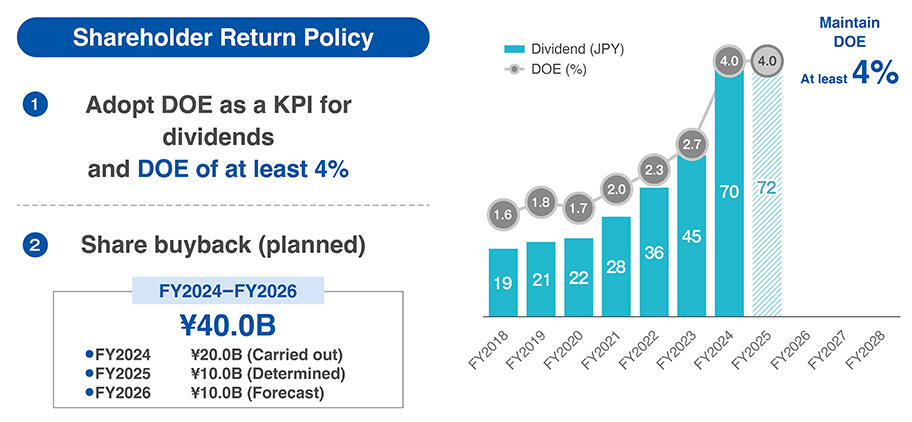

Shareholder Returns

Zeon will seek to expand its business by making new investments while offering continuous and stable shareholder returns. We have adopted a new dividend policy with a DOE (dividend on equity) of 4% or more to maintain stable payments and increase shareholder value.We also plan to allocate a total of 40 billion yen to share buybacks by FY2026 to enhance shareholder returns and improve capital efficiency.

Click here to view presentation materials on the medium-term business plan, published on June 11, 2025.