Corporate Governance

Basic Approach

Zeon aims to increase profits and enhance corporate value on an ongoing basis while respecting and balancing the various interests of its shareholders and other diverse stakeholders. To this end, we continue to work on building a system that enables efficient and sound corporate management through corporate governance. In addition, in our Medium-Term Business Plan: STAGE30, we have set a 30% ratio of foreign-national and/or female directors and officers as a KGI for FY2030, and we are making progress toward realizing board diversity, including gender.

Furthermore, by enhancing our internal control system, we will clarify the functions and division of roles of each body and internal organization to ensure swift decision-making and execution. We will also strive to enhance management transparency through appropriate monitoring and information disclosure regarding our progress and results.

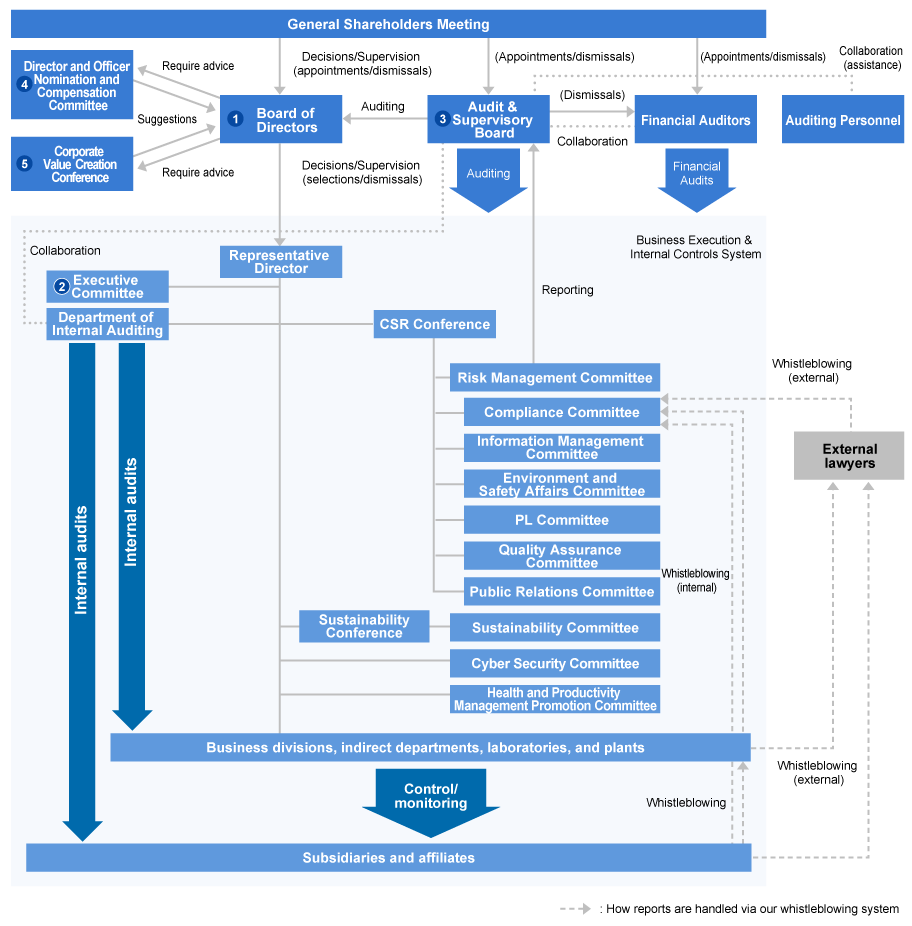

Corporate Governance System

Board of Directors

The Board of Directors meets, in principle, every month with Audit & Supervisory Board members in attendance to ensure compliance with applicable laws and the Articles of Incorporation in the execution of business. In addition to its statutory duties, the Board of Directors makes decisions on basic management policy, strategy, and other important aspects of business execution. The Board of Directors consists of 10 directors, including five outside directors.

Executive Committee

The Executive Committee, in accordance with the Executive Committee Rules, comprises the representative director and executive officers ranked senior corporate officer or above and, in principle, meets twice a month. The committee examines and makes decisions on important business matters after due deliberation based on the opinions of attending full-time Audit & Supervisory Board members. Among the agenda topics, important matters stipulated in the Board of Director Rules are examined and decided by the Board of Directors.

Audit & Supervisory Board

As a company with an Audit & Supervisory Board, we have established an Audit & Supervisory Board comprising five members, including three outside members. The Board reports on, discusses, and adopts resolutions on important matters. In accordance with the auditing guidelines established by the Audit & Supervisory Board, each member audits the status of directors’ execution of their duties through various means, such as attending Board of Directors meetings and monitoring business operations, including subsidiaries’ operations.

Director and Officer Nomination and Compensation Committee

The Director and Officer Nomination and Compensation Committee has been established as an advisory organ to the Board of Directors for the purpose of strengthening the objectivity and transparency of the Board of Directors functions regarding the nomination, compensation, and other matters of directors and officers. Dialogue sessions are also held between corporate officers and other managerial employees, who are future director candidates, and outside officers.

The committee is composed of seven members, of which five are independent outside directors. The committee is chaired by an independent outside director.

Corporate Value Creation Conference

The Corporate Value Creation Conference has been established as an advisory body to the Board of Directors to strengthen the decision-making and oversight functions of the Board regarding the creation of the Zeon Group’s corporate value and activities aimed at reflecting that value in our market capitalization.

The conference is composed of seven members, and its outside members consist of two independent outside directors, two independent outside Audit & Supervisory Board members, and one outside expert (an attorney with no advisory relationship with the company). The conference is chaired by an independent outside director.

Evaluation of the effectiveness of the Board of Directors

Regarding the effectiveness of the Board of Directors, once a year we conduct surveys of directors, and Audit & Supervisory Board members, including outside officers as well as supplementary interviews with each officer. We entrust the analysis and evaluation of the contents to a third-party outside attorney.

The most recent (FY2024) survey and interviews produced results similar to those of previous years, and the effectiveness of our Board of Directors was generally evaluated as high. By extending and securing deliberation time for the Board, discussions at the Board became more active, and as a result of initiatives such as submitting topics including those regarding the Medium-Term Business Plan and business risks, more vigorous discussions than ever took place on the agenda topics.

On the other hand, there were comments that efforts regarding the SDGs and corporate value enhancement were still insufficient, as well as calls for discussions from a longer-term perspective than the Medium-Term Business Plan. These highlight the challenge of devising ways to further deepen Board discussions. We intend to further enhance effectiveness by implementing measures to enrich deliberations, such as expanding the Board’s time frames and clarifying discussion points at the Board from the presenters’ perspective, as well as setting agenda topics on important management themes including financial strategy and long-term management strategy and vision, increasing opportunities to promote outside officers’ understanding of our businesses, and invigorating communication among inside and outside officers.

Director and officer compensation

To serve as one of the sound incentives for sustainable growth, our compensation is structured as described below. Executive compensation for inside directors consists of elements (i) to (iv) below, while that for corporate officers consists of (i), (ii), and (iv). For outside directors, compensation consists solely of fixed-amount cash compensation.

Stock compensation is granted through the Board Benefit Trust-Restricted Stock (BBT-RS). Based on the number of points awarded at a certain time each year, the company will, in principle, grant common shares annually for (iii) and at the end of each phase of the Medium-Term Business Plan for (iv).

The shares to be granted will, pursuant to the agreement with the eligible person, be subject to restrictions on transfer, the creation of security interests, and other dispositions for a certain period. In addition, if any circumstance occurs, such as the eligible person resigning from a position predetermined by the Board of Directors during the transfer-restricted period, except in cases of the expiration of term, death, or other justifiable reasons, the company will acquire the relevant shares without consideration.

Components of remuneration

(i) Cash compensation (fixed)

(ii) Cash compensation (performance-linked)

Evaluation indicators include financial indicators related to the entire company and business divisions for a single fiscal year, as well as the performance against divisional and individual challenges primarily relating to the Medium-Term Business Plan. Each indicator is set with the aim of enhancing the entire Group’s long-term, sustainable growth and profitability.

(iii) Stock compensation (fixed)

(iv) Stock compensation (performance-linked)

Evaluation indicators include financial and non-financial indicators (including ESG-related indicators) linked to the targets in the final fiscal year of each phase of the Medium-Term Business Plan. Each indicator is set with the aim of enhancing the entire Group’s long-term, sustainable growth and profitability.

Cross-shareholdings

For cross-shareholdings, we decide whether to hold such shares only after thoroughly examining, among other factors, whether they contribute to enhancing our medium- to long-term corporate value through strengthening relationships with business partners, local communities, and other stakeholders. For shares acquired following such examination, we annually scrutinize, for each individual issue, the appropriateness of the purpose of the holding and whether the benefits and risks derived from the holding are commensurate with the capital cost, among other factors, thereby verifying the suitability of continued ownership.

In addition, in Phase 2 of the Medium-Term Business Plan: STAGE30, which began in FY2023, we set “Polish up” the management base as one of our Group-wide strategies and, from a financial strategy perspective, established a ratio of cross-shareholdings to consolidated net assets of less than 5% as a target for FY2026, advancing initiatives toward this end. This target has been carried forward into Phase 3 of the Medium-Term Business Plan: STAGE30, which started in FY2025, and we plan to further reduce such holdings to achieve the target.

With respect to the exercise of voting rights for cross-shareholdings, we make appropriate decisions from the standpoint of enhancing the investee companies’ medium- to long-term corporate value.