Climate Change

Basic Approach

With the adoption of the Paris Agreement, efforts toward carbon neutrality have been recognized as a common global challenge, and this movement is now accelerating even further.

Zeon Group considers addressing climate change an important social challenge and aims to realize carbon neutrality. While climate change has a significant impact on the business environment, we recognize it not only as a risk but also as a chance to create new business opportunities.

Based on this approach, we support the TCFD recommendations, disclose information in accordance with the TCFD framework, and promote climate change initiatives integrated with our management strategy.

Carbon Neutrality Master Plan

In our Medium-Term Business Plan: STAGE30, we have set “Promote a transformation of monozukuri to realize carbon neutrality and a circular economy.” Regarding the reduction of greenhouse gas (CO2) emissions (Scope 1 + 2), we aim for a 42% reduction across the entire Group by FY2030 compared to FY2020, and this target has been certified by the Science Based Targets (SBT) initiative.

Disclosure Based on TCFD Recommendations

Governance

Board’s oversight of climate-related risks and opportunities

In July 2021, we established the Corporate Sustainability Headquarters, driving sustainability efforts across the entire Group and promoting the disclosure of their progress and results. We have also carried out activities for “Promote a transformation of monozukuri to realize carbon neutrality and a circular economy,” a Group strategy under our Medium-Term Business Plan: STAGE30. These initiatives are conducted with the approval of the Board of Directors.

The Sustainability Conference and the Sustainability Committee position responding to climate change, including TCFD activities, as an important sustainability issue, carrying out any necessary deliberations and decisions. In addition, the content of the conferences is reported to the Board of Directors four times annually as our sustainability report, with any points raised by the Board reflected in TCFD activities. From FY2024, we established the TCFD Subcommittee under the Sustainability Committee to further improve our company-wide review system.

Management’s role in assessing and managing climate-related risks and opportunities

The Sustainability Conference, whose body is chaired by the company’s Chairman, was established to ensure sustainability-related issues are reflected within the company’s medium- to long-term business plan.

Strategy

Climate-related risks and opportunities the organization has identified over the short, medium, and long term

During FY2020, our rubber business division conducted a 2°C/4°C scenario (RCP2.6/RCP8.5*) analysis and identified and distinguished risks and opportunities. In FY2021, we expanded these efforts, conducting the same scenario analysis on a company-wide basis, and in FY2023, after putting in place the relevant company-wide systems, we implemented scenario analysis based on a 1.5°C temperature increase scenario. In addition, in FY2024 we expanded the scope of the 4°C scenario (RCP8.5) analysis, which had originally been performed with respect to the Takaoka Plant, Kawasaki Plant, Tokuyama Plant, and Mizushima Plant to also include the Himi Futagami Plant and Tsuruga Plant, for a total of six plants, identifying and distinguishing risks with a focus on physical risks.

- *RCP refers to climate change projection scenarios based on greenhouse gas emissions presented by the IPCC. RCP2.6 assumes stringent emission reductions, while RCP8.5 is a high-emissions scenario in which current emissions continue.

Impact of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning

- Business impact assessment

In our TCFD-related activity in FY2020 and FY2021, we identified an increase in raw material procurement costs as a major risk under a 4°C scenario, and identified both an increase in raw material procurement costs and the introduction of new carbon taxes as major risks under a 2°C scenario. Moreover, we reached the assessment that an accelerated shift toward the use of EVs would have a major impact on our business opportunities in the battery materials field. In FY2024, we reassessed the potential impact of this factor, based on an adjustment of the assumptions made regarding sales of EVs and other vehicles when formulating the profit targets for Phase 3 of our Medium-Term Business Plan.

- Climate-related risk priority assessment (identification of risks and opportunities)

In FY2024, in addition to our activities to date, we newly categorized our risks and opportunities related to climate change with a focus on plants, and estimated their impact on profit as shown in the table below.

| Category | Item | Identified risks and opportunities | Overview | Time of emergence *1 |

Impact *2 |

Response measures/taking advantage of opportunities |

|---|---|---|---|---|---|---|

| Transition risks (1.5°C) |

Policy/ Regulation | Carbon tax | Taxation of emissions upon carbon tax introduction (consolidated, both within and outside Japan)*3 | Medium to long term | Significant | Energy conservation, process innovation, and energy conversion |

| LCA and CFP survey costs | Increased LCA and CFP survey costs due to tightened regulation | Short to long term | Small | Examination of effective cost reduction measures | ||

| Changes in customer behavior | ICE reduction and ZEV adoption rate | Decreased sales of products for combustion engines with widespread ZEVs*3 | Short to long term | Moderate | Development of applications tailored to the adoption of EVs, and business portfolio restructuring | |

| Physical risks (4°C) |

Acute | Flood damage (damage to facilities) | Estimate of damage to facilities due to natural disasters*4 | Short to long term | Significant | Disaster preparedness measures, and strengthening of resilience |

| Flood damage (opportunity cost) | Opportunity cost due to natural disasters (assuming a one-month stoppage) | Short to long term | Moderate | Disaster preparedness measures, and strengthening of resilience | ||

| Chronic | Drought response costs | Increased costs due to water transfer from other areas*5 | Short to long term | Moderate | Discussion of drought response strategies and water recycling measures with regional councils | |

| Opportunities

(1.5°C) |

Policy/ Regulation | Carbon pricing and carbon tax | Increased sales opportunities for products that contribute to CO2 reduction | Medium to long term | — | Production and utilization of bio-derived raw materials, and product recycling |

| Individual countries’ carbon emissions targets/policies | Higher demand for storage batteries for renewable energy | Medium to long term | — | Expanding sales of battery materials due to growing demand for storage batteries | ||

| Industry/ Market/ Technology | Key products / Increase or decrease in product prices | Falling raw material prices*3 | Medium to long term | Significant | Formulation of strategies in response to fluctuating crude oil prices | |

| Changes in energy demand | Higher demand for ZB films due to widespread use of energy-saving TVs | Short to long term | Moderate | Development of new film products in response to growing demand for energy-saving TVs | ||

| Increased opportunities for TIM sales due to higher demand for power semiconductors | Medium to long term | — | Development of TIM in response to growing demand for power semiconductors | |||

| Widespread use of low-carbon technology | Increased demand for EV batteries*3 | Short to long term | Moderate | Expanding sales of battery materials due to growing demand for batteries | ||

| Evolution of next-generation technologies | Business opportunities associated with the development of material recycling technology | Medium to long term | — | Establishment of recycling technology | ||

| Reputation | Changes in customer behavior | Customers prefer to adopt products with higher recyclability | Short to long term | — | Achieving premium value through recycled resin | |

| Opportunities

(4°C) |

Acute | Disruption caused to operations by severe natural disasters | Increased sales opportunities resulting from large-scale natural disasters | Short to long term | — | Expanding sales of repair tape, and expanding sales of battery materials due to growing demand for storage batteries |

| Chronic | Rising average temperatures | Increased sales accompanying rising temperatures | Medium to long term | — | Expanding sales of substitute products accompanying a decline in production of naturally-derived products | |

| Water stress | Decrease in natural rubber production due to droughts, etc. | Medium to long term | — | Expanding sales of substitute products accompanying a decline in production of natural rubber |

- *1Time of emergence Short term: Less than 3 years; Medium term: At least 3 years but less than 10 years; Long term: 10 years to 30 years or more

- *2Impact Significant: Estimated impact on profits equal to or more than 5 billion yen; Moderate: Estimated impact on profits ranging from 1–5 billion yen; Small: Estimated impact on profits less than 1 billion yen. “―” indicates that the concrete details of how to implement quantitative assessment of this item will be considered at a later date.

- *3For the 4℃ scenario, estimation was based on the IEA’s STEPS scenario; for the 1.5℃ scenario, estimation was based on the EV sales, crude oil prices, and carbon tax levels used in the IEA’s NZE scenario.

- *4The anticipated amount of damage was estimated as follows: We used the multi-layer hazard maps by Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT) to calculate the depth of flooding for the most severe anticipated torrential rain (once in 1,000 years) at Zeon Corporation’s six plants in Japan, and then used the calculation results in combination with the Manual for Economic Evaluation of Flood Control Investment by the MLIT to estimate the likely extent of damage.

- *5Estimated the cost of transporting water from another area during droughts at the Takaoka Plant, Kawasaki Plant, Tokuyama Plant or Mizushima Plant, all of which use large quantities of water.

Resilience of the organization’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario

In March 2024, Zeon received SBT certification, for our goal of reducing greenhouse gas emissions to a level that would keep the average global temperature increase within 1.5°C. In FY2023, we implemented 1.5°C scenario analysis under a company-wide system, and defined strategies to respond to the risks and opportunities that we identified and distinguished through this analysis.

In FY2024, we rolled out this initiative at all our plants and worked to further strengthen our strategy based on the results of past activities, as part of the discussion for Phase 3 of our Medium-Term Business Plan.

Risk management

Processes for identifying and assessing climate-related risks

We are striving to further enhance our efforts by implementing the 4°C and 1.5°C scenario analyses that we have been conducting, as well as the identification and classification of transitional and physical risks associated with climate change projected for FY2030 and beyond based on the relative importance, on an annual basis. In FY2024, we added two more plants to the four previously analyzed, conducting transitional and physical risk identification and to impact assessment.

Processes for managing climate-related risks

Climate-related risks identified and distinguished via TCFD activities are discussed by the Sustainability Committee and deliberated and decided on at the Sustainability Conference. Regarding the response to each risk, after implementing risk assessment by considering the frequency of occurrence and the impact, we work to reduce and manage risk by implementing advance prevention for potential risks, and post-facto response measures for actualized risks.

How processes for identifying, assessing, and managing climate-related risks are integrated into the organization’s overall risk management

We have established a system whereby the Risk Management Committee monitors and discusses risks throughout Zeon Group, and reports on the results to the CSR Conference, which is chaired by the representative director. In FY2024, the TCFD Subcommittee added new climate risks, such as heatstroke due to rising summer temperatures and the risk of water shortages caused by drought which had been identified primarily at our plants, to the company-wide risk assessment framework. Company-wide risks and climate change risks are reported to and managed by the Board of Directors.

From FY2025 onwards, we will continue to review climate change related risks as necessary, implementing risk reduction and management through discissions and deliberations at the Sustainability Committee and Sustainability Conference.

Metrics and targets

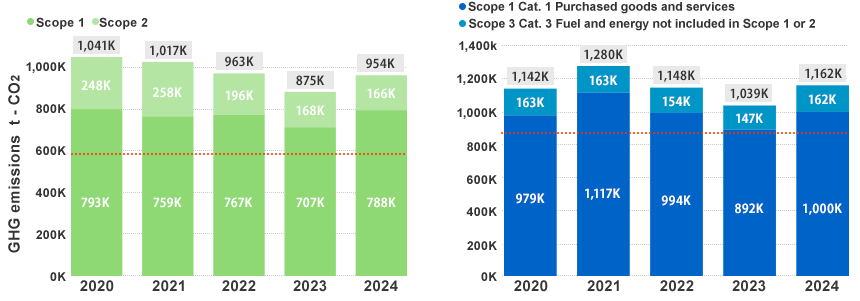

GHG emissions

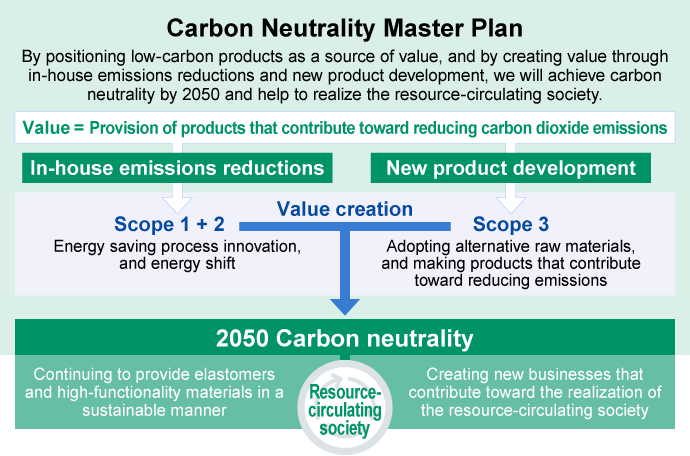

Zeon formulated its first Carbon Neutrality Master Plan in April 2022.

In this plan, we have set the target of reducing Zeon Corporation’s Scope 1 + 2 CO2 emissions by at least 50% by FY2030, compared to the level of emissions in FY2019.

We have adopted three approaches to reduce Scope 1 and 2 emissions: 1) Energy conservation; 2) Process innovation; and 3) Energy conversion.

In addition, in FY2023 we established the following Scope 1 + 2 and Scope 3 reduction targets for Zeon Group as a whole.

| Item | Base year | Target year | Reduction target |

|---|---|---|---|

| Scope 1, 2 | 2020 | 2030 | 42% reduction (1.5°C level) |

| Scope 3 | 25% reduction (WB 2.0°C level) |

We obtained SBT certification in March 2024 and unified the Group-wide targets into the reduction targets shown in the table above, which were set in FY2023. The method for calculating GHG emissions complies with the GHG Protocol.

*Emission factors used for calculating emissions

Scope 1: Emission factors set by the SHK system for greenhouse gas emissions

Scope 2: Emission factors set by the SHK system for greenhouse gas emissions and emission factors for each electric utility

Scope 3: The Ministry of the Environment’s emission factor database for corporate GHG emissions accounting over the supply chain

Compensation system

In FY2023, Zeon introduced a performance-linked stock compensation system for directors and officers. When calculating compensation, the evaluation indicators used include financial and non-financial indicators (including ESG-related indicators) that are linked to the target values for the final year of each phase of the Medium-Term Business Plan.

Key Initiatives

Expressing support for the TCFD recommendations and CO2 emission reduction initiatives

In August 2020, Zeon Corporation expressed its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Based on the TCFD recommendations, we analyze the risks and opportunities that climate change poses to our business and reflect them in our business strategies to strengthen our business foundation, while also aiming to realize a sustainable society and improve Zeon’s corporate value.

These initiatives are also reflected in “Promote a transformation of monozukuri to realize carbon neutrality and a circular economy,” which is outlined in our Medium-Term Business Plan. Over the medium to long term, we will disclose our initiatives to realize the Carbon Neutrality Master Plan, with 2050 as the target year, as well as the progress made in reducing CO2 emissions.

For specific disclosures, please refer to Disclosure Based on TCFD Recommendations.

CO2 emission reduction initiatives

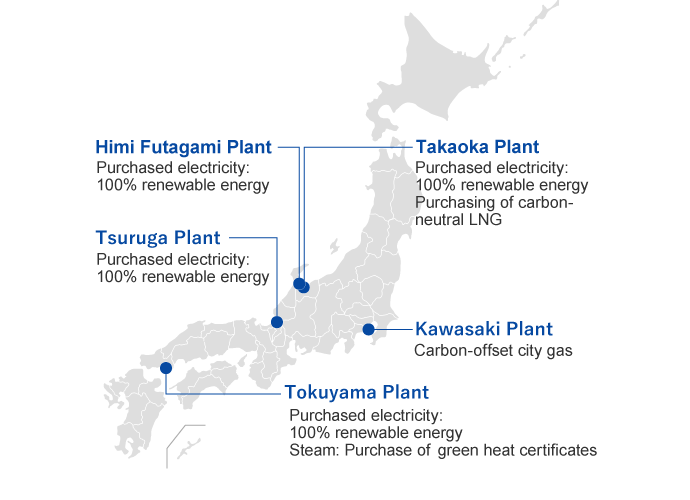

Energy shift in plants in Japan

At four of our production sites in Japan (Takaoka Plant, Himi Futagami Plant, Tsuruga Plant, and Tokuyama Plant), we have converted all purchased electricity to 100% renewable electricity or to electricity effectively derived from renewable energy by utilizing renewable energy-designated non-fossil certificates.

Furthermore, at the Takaoka Plant, we have concluded a purchase agreement for carbon-neutral LNG with effectively zero CO2 emissions.

At the Tokuyama Plant, we have entered into a purchase agreement for green heat certificates to reduce CO2 emissions from steam.

In addition, at the Kawasaki Plant, we have adopted Tokyo Gas Co., Ltd.’s carbon-offset city gas and have also joined the Carbon Offset City Gas Buyers Alliance.

Adoption of internal carbon pricing (ICP) program

- 1Internal carbon price: 10,000 yen/t-CO2

- 2Scope of application: Capital investment that will lead to an increase or decrease in CO2 emissions

- 3Method of application: The increase or decrease in CO2 emissions accompanying the capital investment project in question will be converted into a monetary amount using the internal carbon price, and this will be taken into account when making the decision as to whether or not to invest in the project.

Selected for NEDO* Green Innovation Fund Projects

- Development of manufacturing technology using carbon recycling for commodity chemicals used in synthetic rubber

This demonstration project aims to establish two advanced technologies to produce butadiene and isoprene, which are key synthetic rubber chemicals, at high yield rates, using renewable carbon resources such as used tires and biomass as feedstocks, and to implement those technologies in society in the 2030s.

In February 2025, we decided to introduce bench-scale equipment for a technology that efficiently produces butadiene from ethanol, including plant-derived ethanol. This will accelerate full-fledged technology verification and scale-up toward social implementation.

- *NEDO: New Energy and Industrial Technology Development Organization

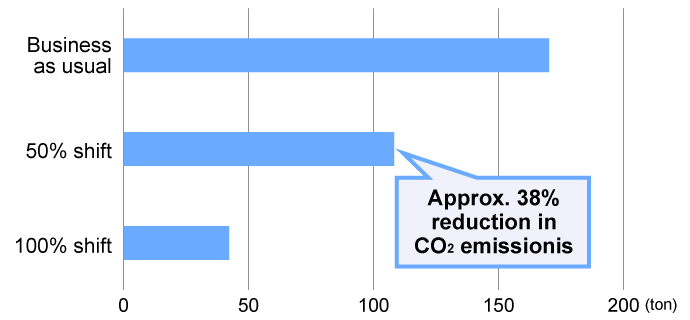

Act and efforts to reduce CO2 emissions in logistics

As a specified consigner under the revised Energy Conservation Act, we are working to rationalize the use of energy together with partner companies involved in product and raw materials transportation. To date, we have studied and implemented various measures, including improvements in loading efficiency, modal shift to rail and ship transportation, and truck and ship fuel efficiency.

In particular, for truck transportation, we plan to shift from using domestic long-haul truck transportation to rail and coastal ship transportation, aiming to contain future transportation costs and reduce CO2 emissions..

An example of this is switching truck transportation to rail transportation while containing cost increases for a portion of raw materials transportation in Japan. At present, as a result of the modal shift to rail transportation for about half of the shipped volume, we have been able to reduce CO2 emissions by approximately 38%, according to Zeon estimates. We will continue to take further steps to shift the total shipping volume.